Making Real Estate

International, specialized, independent

Real estate funds, separate account mandates and green real estate solutions: The KanAm Grund Group combines comprehensive services under one roof – with a focus on institutional and semi-professional investors. To do so, we have built a network of subsidiaries in the most important European markets since our foundation in 2000.

> 31.2

billion euros

in transaction volume

> 395

transactions, property purchases and sales

> 85

cities in which we have invested since 2000

7

locations in Germany, Europe and the USA

Stand 31. March 2025

The information relates to the period from 2000 and includes all companies belonging to the KanAm Grund Group, i.e. KanAm Grund Kapitalverwaltungsgesellschaft mbH, KanAm Grund Institutional Kapitalverwaltungsgesellschaft mbH and KanAm Grund Real Estate Asset Management GmbH.

Experienced, dynamic,

value-oriented:

The KanAm Grund Group ...

With local end-to-end services for you

The KanAm Grund Group is at the investors’ side: with offices in Frankfurt am Main Germany, five other European cities and Atlanta, USA.

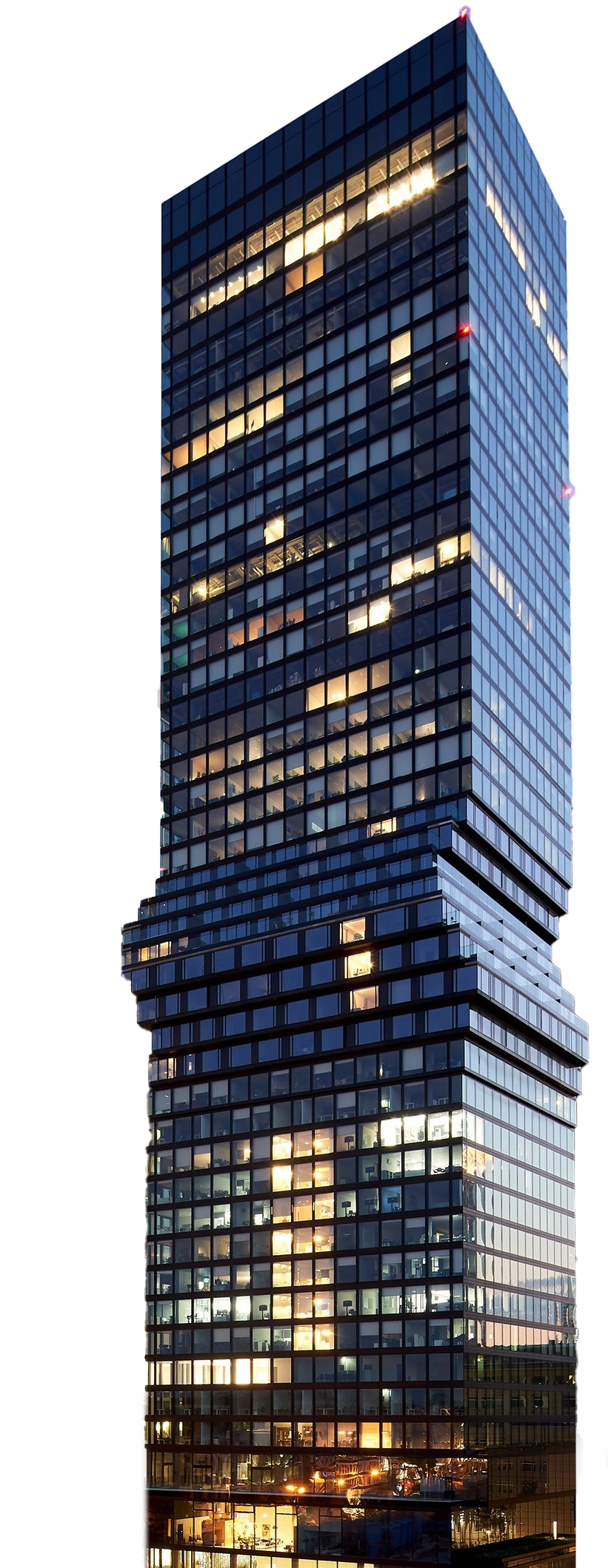

Frankfurt am Main

Headquarter KanAm Grund Group

OMNITURM

Große Gallusstraße 18

60312 Frankfurt am Main

Luxemburg

Branch KanAm Grund Group

51, Boulevard Grande Duchesse Charlotte

1331 Luxembourg

Paris

Branch KanAm Grund Group

120 Avenue des Champs Elysées

75008 Paris

London

Branch KanAm Grund Group

5-10 Bolton Street

London, W1J 8BA

Madrid

Branch KanAm Grund Group

Torre Europa

Paseo de la Castellana 95

28046 Madrid

Atlanta

Branch KanAm Grund Group

1200 Abernathy Road NE, Suite 1525

Atlanta, GA 30328

Brussels

Branch KanAm Grund Group

Av. De Tervueren 242A

1150 Bruxelles

A focused group with a clear structure

A modular service programme for investors – with an experienced team of experts. We have structured these into three customer-oriented business areas.

Within the KanAm Grund Group, services are provided by three companies. While KanAm Grund Institutional Kapitalverwaltungsgesellschaft mbH is active in the area of special property funds, KanAm Grund Kapitalverwaltungsgesellschaft mbH covers the area of open-ended property funds. KanAm Grund Real Estate Asset Management GmbH provides services in the areas of asset management, separate account mandates, and green real estate solutions, among others.

Well-established and experienced team

The international management team contributes to the KanAm Grund Group’s sustained growth – as do the dedicated team members.

Many of our staff have been an integral part of the management team for many years.

Track record since 2000

Milestones on the road to success

2000: Founding of KanAm Grund Kapitalverwaltungsgesellschaft mbH; Germany’s first private, independent real estate investment company

2001: First provider of purely international open-ended real estate funds in Germany

2001: KanAm Grund Group’s first public fund: KanAm grundinvest Fonds

2001: Establishment of KanAm Grund Institutional Kapitalverwaltungsgesellschaft mbH to support institutional investors

2003: First US-dollar-based fund: KanAm US-grundinvest Fonds

2005: Launch of the first fund for institutional investors with an investment focus on Europe

2005: Expansion of the international network: Opening of KanAm Grund Group subsidiary in Paris, France

2007: Opening of subsidiary in Atlanta, USA

2013: Launch of the first new-generation open-ended real estate fund under the KAGB: LEADING CITIES INVEST

2013: Foundation of the KanAm Grund Group and KanAm Grund Real Estate Asset Management GmbH & Co. KG: Diversification and expansion of the separate account business with all services from a single source

2013: Development of data-based scoring models (C-Score) for the evaluation and identification of real estate markets and investment locations

2014: Launch of a rapidly growing family of individualised and specialised real estate special funds (AIFs)

2014: Opening of the Luxembourg subsidiary for improved access to local markets

2015: Opening of subsidiary in London, UK

2017: Introduction of the ‘G-Score’ scoring model for the special features of the German market as a further development of the data-based C-Score model developed in 2013 for the evaluation and identification of real estate markets and investment locations

2018: First special fund that enables institutional investors to participate in project developments (development fund)

2019: Foundation of Korean Desk in Frankfurt to support Korean investors

2020: First special fund that enables investors to invest in real estate leased to public institutions (KanAm Grund Öffentliche Institutionen Deutschland)

2021: Opening of subsidiary in Madrid, Spain

2022: Categorisation of the LEADING CITIES INVEST open-ended mutual fund as an ‘Article 8-plus fund’ under the SFDR/MiFID II Disclosure Regulation

2023: Launch of ‘Green Real Estate Solutions by KanAm Grund Group’: comprehensive sustainability portfolio for institutional investors

2024: Publication of the KanAm Grund Group's first sustainability report for fiscal year 2023.

Purpose, mission and values

We work on a firm foundation of clear guidelines and values. Everyone who works for or with us can feel this: Investors, employees, partners and shareholders as well as the general public. As an international, independent real estate specialist, we have been a successful pioneer in the industry for decades – and our impressive track record makes us the first choice for our investors.