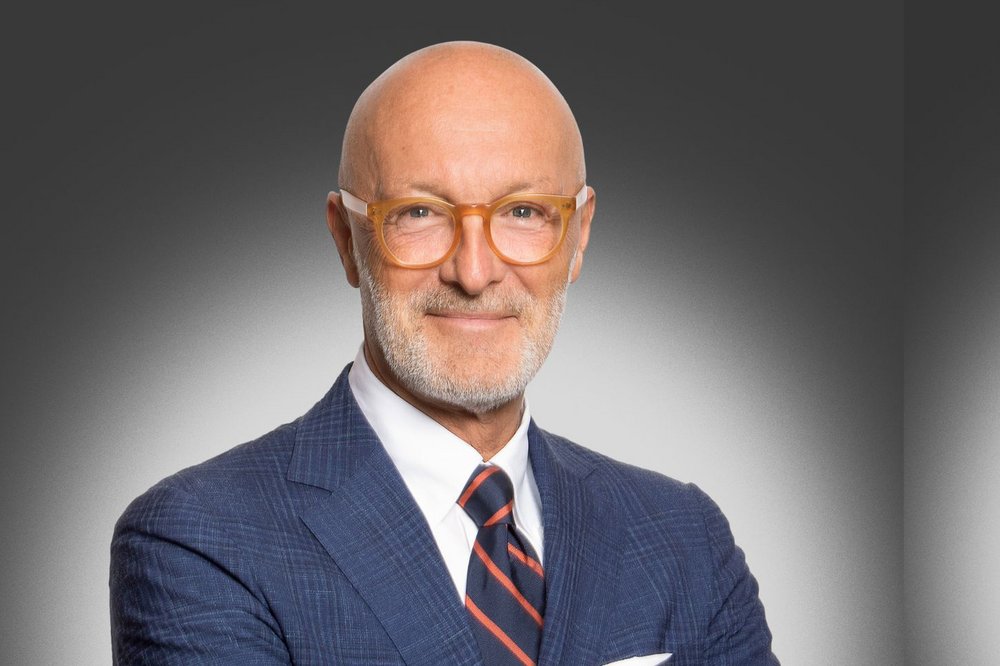

- Hans-Joachim Kleinert: ‘The time has now come to retire from my operational involvement. Our well-established management team continues to guarantee investors and business partners outstanding innovative strength, professionalism, continuity and reliability.’

- Retirement as Managing Partner with effect from June 30, 2023; member of the Supervisory Board as of July 1, 2023.

Hans-Joachim Kleinert (62) will retire as CEO and Managing Partner of the KanAm Grund Group with effect from June 30, 2023. He will remain a partner and will be available in future as an adviser to the management. The new chairperson of the management will be Olivier Catusse (47), who is also a managing partner. Hans-Joachim Kleinert will be a member of the Supervisory Board of KanAm Grund Group as of July 1, 2023. This has been announced in today’s meeting of the Supervisory Board.

Hans-Joachim Kleinert, founding partner of KanAm Grund Group, says: ‘I have decided to take this step after careful consideration. In the 24th year of my managerial activities for my KanAm Grund Group the time has now come to retire from my operational involvement at the age of nearly 63 and to focus on other priorities in my private life. I have plenty of ideas, plans and goals. The successful implementation of the complete realignment and modernization of the KanAm Grund Group has created the basis to hand over the reins to my long-standing managing co-partner and CIO, Olivier Catusse. The new CEO and the entire management team have already been working together constantly and successfully for between 10 and 20 years. Sascha Schadly, Jan Jescow Stoehr, Heiko Hartwig, and Anthony Bull-Diamond (who will join and strengthen the management team in January 2023) have already shown their excellent abilities over the last few years. These abilities guarantee investors and business partners outstanding innovative strength, professionalism, continuity and reliability.‘

Olivier Catusse, Managing Partner at KanAm Grund Group, adds: ‘Hans-Joachim Kleinert is now the second of the founding managers to leave the KanAm Grund Group which was established in October 2000 and to enjoy a well-earned retirement, following Matti Kreutzer in 2014. Hans-Joachim Kleinert brought me into the company in 2003. For over two decades our collaboration has been characterized by a high level of professionalism, an open and very pleasant working relationship, mutual respect and a shared determination to dare to be special and achieve outstanding results. This is something I am very thankful for. At the same time, I also look forward to my new tasks and my continued cooperation with Hans-Joachim Kleinert on the Supervisory Board.‘

Time for a résumé: KanAm Grund Group – from the beginning up to the present

In 1999, Hans-Joachim-Kleinert and Matti Kreutzer started together as managers of KanAm International GmbH, based in Munich, with the goal of establishing and building up the first private real estate asset management company in Germany, despite a fierce competitive environment. This was followed by more than twenty exciting and mainly very successful years with the KanAm Grund Group. Following the launch of the first internationally invested, open-ended real estate fund, they jointly mastered the crisis of the open-ended real estate funds in the years 2004/2005. KanAm Grund recorded high inflows in this period. With this performance, the company earned respect from the outset as an independent startup.

In 2006, forced by a rating agency, the first real estate fund had to be closed down, and was successfully relaunched. This was followed by the financial market crisis in 2006 with dramatic consequences, for many other renowned and globally operating real estate fund providers as well. KanAm Grund had to liquidate some funds. Some years later the company was bestowed with the Scope Award for its transparent approach involving investors. According to Hans-Joachim Kleinert, this has been the biggest and most complex challenge in the company’s history so far.

In 2013, due to their great commitment, the expertise and experience gained over the years and a wide-ranging network, Hans-Joachim Kleinert and his team succeeded in establishing important protective mechanisms in the legislation process of the German Investment Code (KAGB) – in spite of resistance from parts of the industry. This was directly followed by the launch of the first open-ended retail real estate fund designed in line with the protective measures of the new Investment Code, with notice and minimum holding periods for all investors: the LEADING CITIES INVEST.

Since 2014, the focus has been on restructuring and modernizing the KanAm Grund Group, in line with the Strategy 2020 and 2025, with the aim of creating a sustainable and strong international real estate expert for retail and institutional investors. As a one-stop shop, the company with around 150 employees now comprehensively covers the risk categories Core, Core+, Value Add and Development, both in Germany, other European countries and the USA via open-ended real estate funds, specialized institutional real estate funds, separate account solutions, and club deals. Since then, the company has won several awards and is currently managing a total transaction volume of more than 30 billion euros - despite the Covid 19 crisis that began in early 2020 - and currently manages more than 7 billion euros in assets under management. Moreover, in 2020/2021, the company moved into its new headquarters at OMNITURM in Frankfurt am Main with an absolutely trailblazing office concept and an extremely attractive interior design, and opened further European branch offices in addition to an office in the USA. There are now offices in Atlanta, Dublin, London, Luxembourg, Madrid, Munich and Paris that enable proximity to these markets.

Thus, the course is set for continued success of KanAm Grund Group, its investors and business partners.